-

Markets

DerivativesCorporate ActionMutual FundsOpen StoreYou may be interested

-

Products

PlatformsInvestingTradingHNI Services

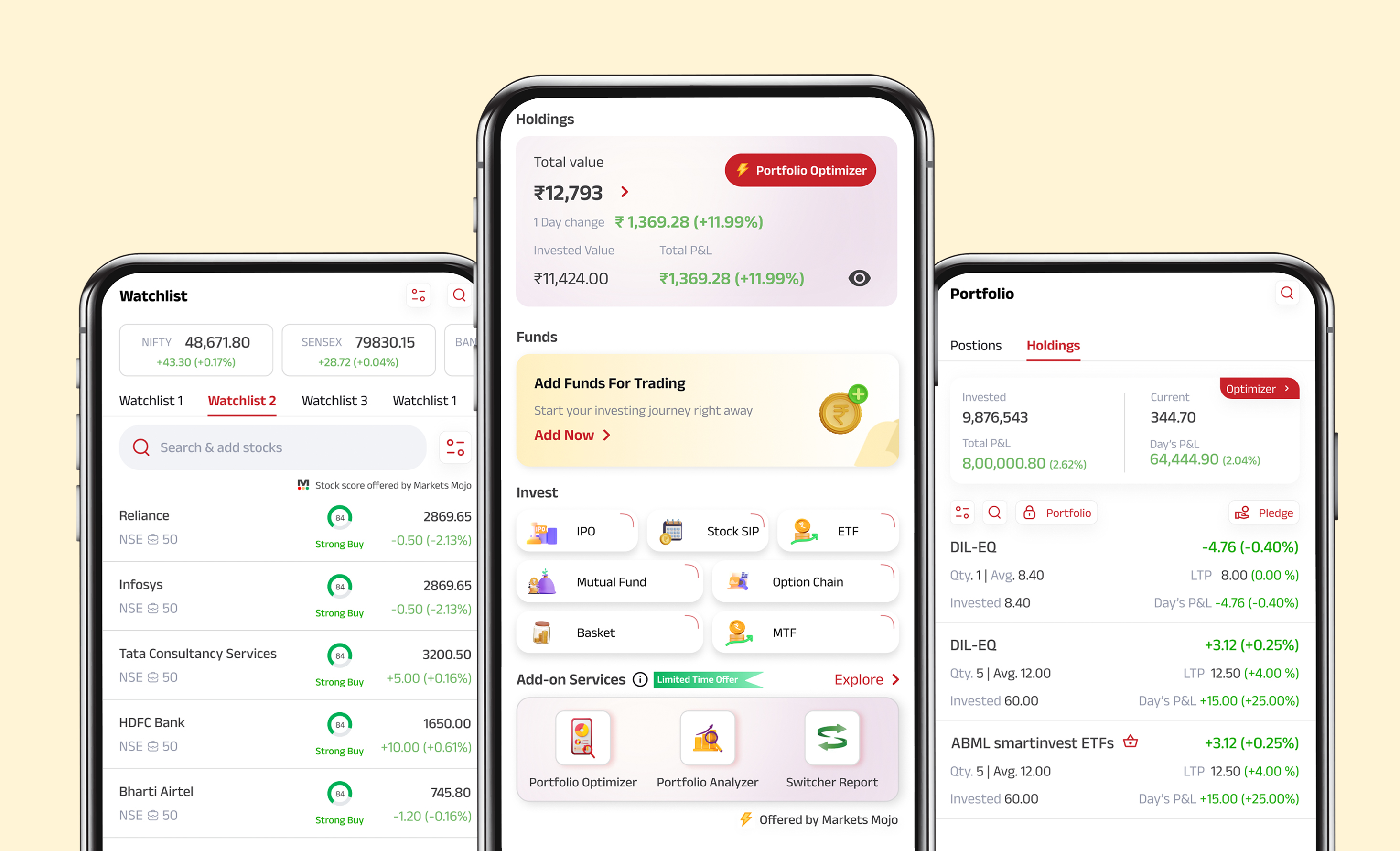

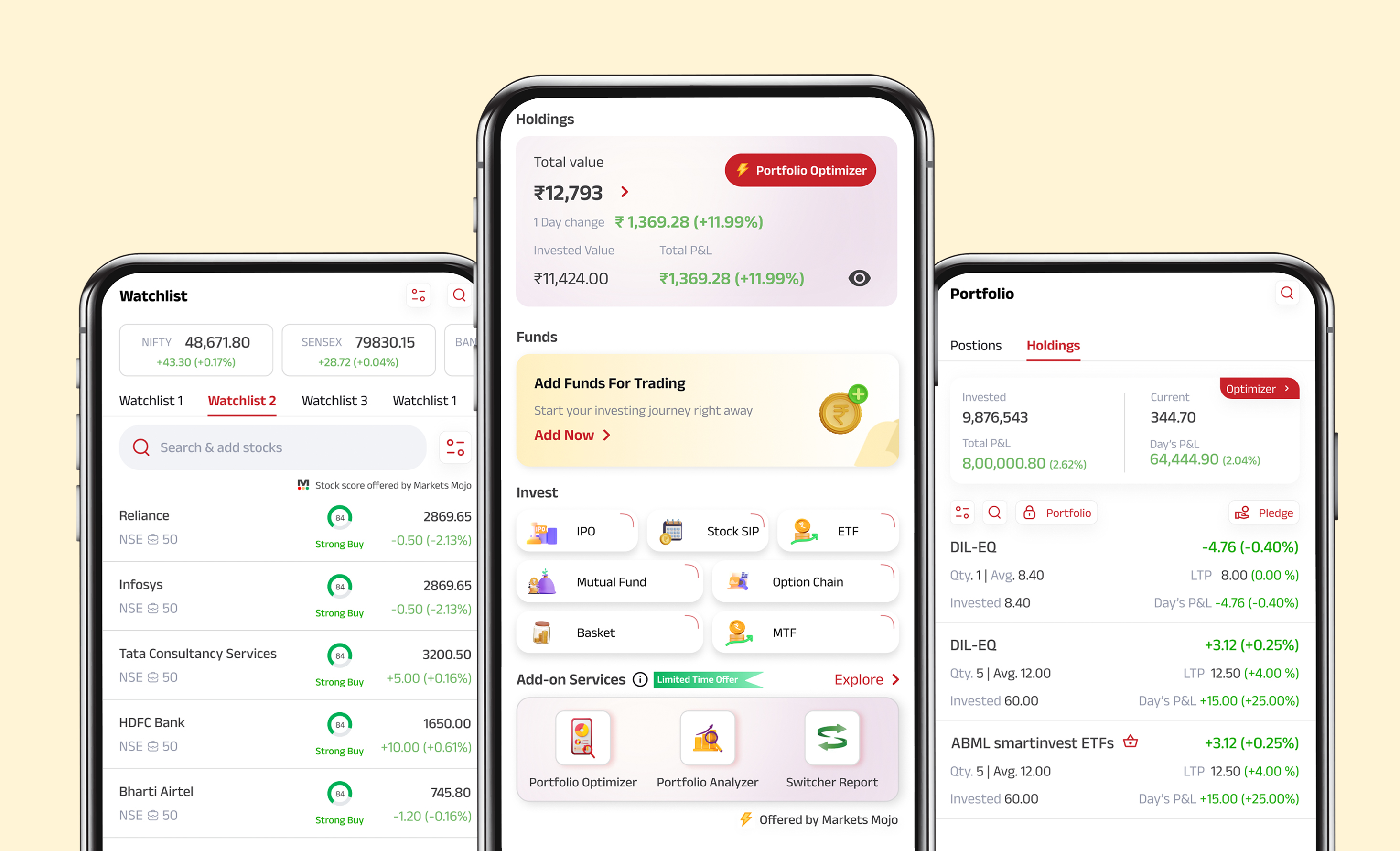

One stop solution for all stock market enthusiasts

- Intuitive Watchlist

- Detail Quote

- Charting

- and much more

-

Research

Equity Technical Report Daily Morning Update Fundamental Report

- Thematic Reports

- Result Update

- Monthly Economic Report

- Event Update

- IPO Note

- Management Meet Update

- Initiating Coverage

CurrencyInvestPacks

One stop solution for all stock market enthusiasts

- Intuitive Watchlist

- Detail Quote

- Charting

- and much more

-

Learn

Demo Center

-

Support

For Broking services

Call Toll Free Number :

1800-270-7000

( Mon - Fri: 9AM - 11PM )

( Sat & Sun: 9AM - 09PM )

Help/FAQs -

Partner Us

-

ABC Solutions

Loans

Investments

Alternative Investments

Insurance

Download ABCD

Playstore

Playstore

Appstore

Appstore

Experience finance made simple on the new ABCD app!

Scan to Download the App

Playstore

Playstore

Appstore

Appstore

Aditya Birla Money Limited

Aditya Birla Money Limited

1800-270-7000

1800-270-7000

Get a Free Call

Get a Free Call Tools and Calculator

Tools and Calculator